The Buzz on G. Halsey Wickser, Loan Agent

Table of Contents8 Simple Techniques For G. Halsey Wickser, Loan AgentSome Of G. Halsey Wickser, Loan AgentRumored Buzz on G. Halsey Wickser, Loan AgentThe Single Strategy To Use For G. Halsey Wickser, Loan AgentGetting The G. Halsey Wickser, Loan Agent To Work

A mortgage broker (mortgage lenders in california) acts as an intermediary between a person that intends to acquire property and those providing financings to do so. Mortgage brokers help prospective customers discover a lender with the most effective terms and prices to meet their financial needs. In the wake of the actual estate market accident in 2008, the business methods of brokers came under analysis, and the inquiry of whether they act in consumers' finest passions was elevated.

All the very same, there are benefits and drawbacks to using a home mortgage broker. Functioning with a mortgage broker can potentially conserve you time, effort, and money.

When you consult with feasible home mortgage brokers, inquire to information exactly how they'll help you, all their fees, the lending institutions they deal with, and their experience in the service. A home mortgage broker carries out as go-between for a banks that offers fundings that are secured with realty and people that desire to acquire realty and require a lending to do so.

An Unbiased View of G. Halsey Wickser, Loan Agent

A loan provider is a banks (or private) that can provide the funds for the genuine estate purchase. In return, the customer repays the funds plus a set amount of interest over a certain span of time. A loan provider can be a bank, a credit score union, or various other financial business.

While a home loan broker isn't required to facilitate the transaction, some lending institutions may just work via mortgage brokers. If the loan provider you choose is amongst those, you'll require to make use of a home loan broker.

Little Known Facts About G. Halsey Wickser, Loan Agent.

When conference potential brokers, get a feel for how much interest they have in assisting you get the loan you need. Ask about their experience, the specific aid that they'll give, the costs they bill, and how they're paid (by loan provider or consumer).

That stated, it is useful to do some research study of your very own before satisfying with a broker. An easy way to swiftly get a sense of the average rates offered for the kind of mortgage you're applying for is to look rates online.

The Main Principles Of G. Halsey Wickser, Loan Agent

Several various types of costs can be involved in taking on a brand-new home loan or functioning with a brand-new loan provider. In some situations, mortgage brokers might be able to obtain lenders to forgo some or all of these charges, which can save you hundreds to thousands of bucks.

Some lending institutions may use home customers the identical terms and prices that they provide mortgage brokers (sometimes, even better). It never ever harms to look around by yourself to see if your broker is really offering you a good deal. As stated earlier, making use of a mortgage calculator is a simple method to reality check whether you can discover much better options.

If the charge is covered by the lender, you need to be worried concerning whether you'll be steered to an extra expensive car loan since the payment to the broker is extra financially rewarding. If you pay the cost, number it into the home mortgage costs prior to choosing exactly how good an offer you are getting.

Fascination About G. Halsey Wickser, Loan Agent

Spend a long time contacting loan providers directly to obtain an understanding of which home loans may be available to you. When a home loan broker initially offers you with deals from loan providers, they frequently make use of the term excellent faith quote. This indicates that the broker thinks that the offer will certainly symbolize the last regards to the bargain.

In some instances, the lending institution might transform the terms based upon your real application, and you might end up paying a higher price or extra fees. This is a boosting fad given that 2008, as some lenders located that broker-originated home mortgages were extra likely to enter into default than those sourced through direct lending.

The broker will accumulate (https://halseyloanagt.picturepush.com/album/3319531/16767742/G.-Halsey-Wickser%2C-Loan-Agent/G-Halsey-Wickser-Loan-Agent.html) details from a specific and most likely to several loan providers in order to discover the ideal prospective loan for their customer. They will examine your credit history to see what sort of finance arrangement they can come from in your place. Ultimately, the broker functions as the lending policeman; they collect the essential info and collaborate with both celebrations to get the car loan closed.

Michael Bower Then & Now!

Michael Bower Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Rachael Leigh Cook Then & Now!

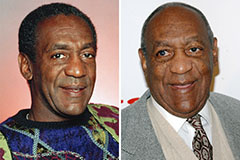

Rachael Leigh Cook Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!